|

|

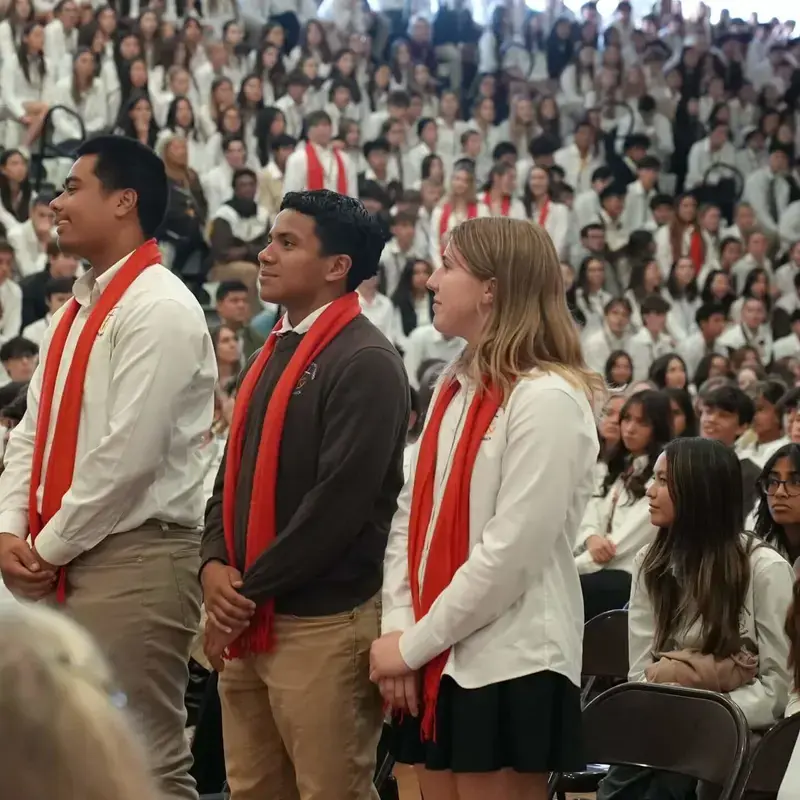

An exceptional Holy Cross Catholic education is made possible by the ongoing generosity of our alumni, parents, past parents, friends, educators and corporate partners. Their support helps fund the programs and opportunities that enable us to fulfill our mission. We are thrilled you're here and grateful for your interest in joining us in this transformational work.

“To succeed in the important undertaking entrusted to us, we must be, first of all, so closely united in charity as to form but one mind and one soul.”

Blessed Basil Moreau

Circular Letter 1; 1835

Our Mission

In the tradition of the Catholic Church and the spirit of Holy Cross, Saint Francis High School is committed to providing the finest college-preparatory program in an inclusive family environment, encouraging students to achieve their highest potential through:

- Spiritual Development which expresses their Christian values in the convictions of their hearts and the actions of their hands;

- Intellectual Development which translates their knowledge and skills into independent and creative thinking;

- Social Development which transforms their activities and experiences into leadership in and service to the community.

Where Next?

How Can We Help?

We understand that you may have questions about your donation or how you can make a difference. Please don’t hesitate to reach out – we're happy to assist you every step of the way.

|

Carolina Scipioni |

Saint Francis High School is a 501(c)3 tax-exempt nonprofit organization.

Federal Tax ID# 94-1337628